ASAP Digital Savings Account

-->

Zero Balance Savings Account

Get an Axis Bank zero balance a/c @Rs.150 p.m. & enjoy no charges on banking transactions

Choose from accounts tailored as per your needs

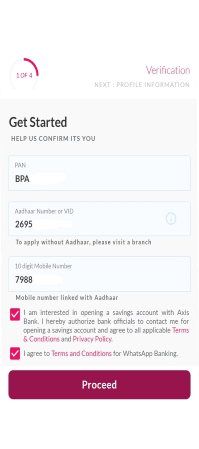

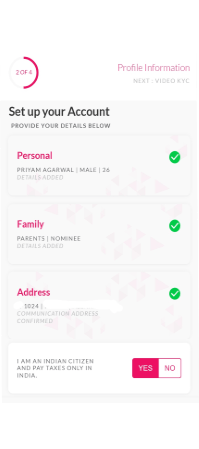

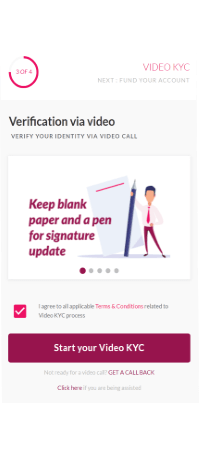

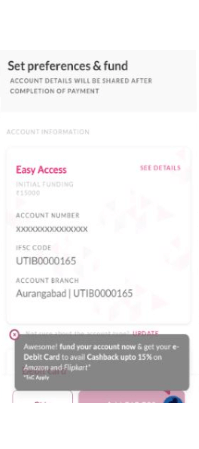

Open an ASAP Digital Savings Account to unlock exciting offers in just 4 Steps

- No Minimum Balance Required* Sign up at just ₹ 200/p.m. or ₹ 2,200/p.a.

- Complimentary 3 months Amazon Prime membership worth ₹ 599*

Get BookMyShowmovie package valued at ₹ 4000, offering a flat discount of ₹ 400 per ticket*

- Get complimentary Swiggy Dine Out voucher worth ₹ 500*

- Get complimentary 3 months Swiggy One membership worth ₹ 400*

- Get discounted ride package from Uber worth ₹ 500*

- Earn 2000 Edge Reward points every month on achieving a spend milestone of ₹ 20,000 p.m. on payments made via

- Online Rewards Debit Card

- E-Debit Card

- UPI merchant transactions done through Axis Pay App or Mobile Banking App, open by Axis Bank

- Enjoy No Charges on ATM withdrawals & 30+ benefits

- Insurance benefits on Physical Online Rewards Card:

- Personal Accident Cover of

₹ 5,00,000

- Air Accident Cover of ₹ 1 Crore

- Purchase Protection Cover of ₹ 50,000

- Loss of Baggage/Delayed Baggage Cover of upto 500 USD

*The offers are applicable on completing first debit card transaction.

Open an ASAP Digital Savings Account to unlock exciting offers in just 4 Steps

- Get guaranteed 10% cashback every time you shop on Flipkart via Grab Deals.

- Get a ₹ 500 shopping voucher redeemable via Grab Deals on completing first Debit Card transaction using Online Rewards Card within 30 days of account opening. Choose to shop across 150+ brands.

- Avail 1% cashback on Online Spends through E-Debit Card. (*Click here to view excluded merchant categories)

- Milestone Benefits: Get 2000 EDGE REWARD points on annual spends of ₹ 1,00,000/- through E- Debit Card

- Buy 1 Get 1 movie ticket on BookMyShow via e-debit card

- Insurance benefits on Physical Online Rewards Card:

- Personal Accident cover of

₹ 5,00,000

- Air Accident cover of ₹ 1 Crore

- Purchase Protection cover of ₹ 50,000

- Loss of Baggage/Delayed Baggage cover upto 500 USD

- Accelerated eDGE Reward points on Physical Online Rewards card:

- Earn higher eDGE reward points for transactions online and offline:

10X (Travel booking)

5X (Electronic purchase)

3X (Online food delivery)

2X (clothing stores)

Open an ASAP Digital Savings Account to unlock exciting offers in just 4 Steps

- Get flat 10% cashback every time you shop on Flipkart via Grab Deals.

- Earn 1 EDGE REWARDS Point for every Rs. 200 spent on domestic and international transactions.

- Get a ₹ 500 shopping voucher redeemable via Grab Deals on completing first Debit Card transaction within 30 days of account opening. Choose to shop across 150+ brands.

- Annual Savings worth ₹ 15,000

- 5% weekend cashback benefit of up to ₹ 6,000 per year

- Dining Delights offers worth ₹ 4,800 per year

- Banking priviliges worth ₹ 2,820 peryear

- Gift voucher worth ₹ 750 per quarter

- Enjoy flat 5% cashback upto ₹ 500 on Saturday & Sundays on spends across Food, Entertainment, Shopping & Travel via Liberty Debit Card.

- Enjoy a gift voucher worth ₹ 750 of your choice on spends of ₹ 60,000 in a financial quarter. Choose vouchers from across Amazon.in, Ola, Croma, Lifestyle & Spencer’s.

Open an ASAP Digital Savings Account to unlock exciting offers in just 4 Steps

- Get guaranteed 10% cashback every time you shop on Flipkart via Grab Deals.

- Get flat 10% cashback at every purchase on Amazon.in via Grab Deals.

- Annual Benefits worth ₹ 25,000 on Prestige Debit Card

- Dining Delights Discounts & Cashback on spends worth ₹ 14,000

- Complimentary services like Demat AMC waiver, insurance covers, locker discounts, Debit & Credit Card fee waiver worth ₹ 5,100

- Reward points worth ₹ 2,400

- Everyday banking benefits worth ₹ 3,500

- Get a cashback of 1% on fuel, 2% on shopping & 3% upto ₹ 500 on travel everytime when you pay through Prestige Debit Card.

- Your Digital Relationship Manager would be available for your assistance 24*7 through the prestige toll free no. 18005721888.

- Personal Accidental Death Cover of ₹ 10 Lakhs

TnC Applicable

- Avail 1% cashback on Online Spends through E-Debit Card. (*Click here to view excluded merchant categories)

- Milestone Benefits: Get 2000 EDGE REWARD points on annual spends of Rs. 1,00,000/- through E-Debit Card.

- Get complimentary My Zone Credit Card:

- Swiggy 40% discount on minimum transaction value of ₹ 200

- Buy 1 get 1 offer on Paytm Movies upto ₹ 200 once a month

- SonyLIV 12 months subscription on successful activation

- 4 Edge Rewards for every ₹ 200 spent on card

- 2X Accelerated Axis EDGE reward points on Prestige Debit Card.

Open an ASAP Digital Savings Account to unlock exciting offers in just 4 Steps

- Connect with your dedicated Relationship Manager 24*7 through Axis MB app

- 8 complimentary access to select lounges at the airports within India (2 per quarter).

- Up to 50% discount on locker rent. Book your lockers digitally at your convenience through our Mobile or Internet banking.

- 25% discount on movies on BookMyShow (Up to ₹ 350 per month)

- Complimentary Axis Bank Club Vistara Forex Card with Complimentary Club Vistara membership

- Get guaranteed 10% cashback every time you shop on Flipkart via Grab Deals.

- Get flat 10% cashback at every purchase on Amazon.in via Grab Deals.

- Avail 1% cashback on Online Spends through E-Debit Card. (*Click here to view excluded merchant categories)

- Milestone Benefits: Get 2000 EDGE REWARD points on annual spends of Rs. 1,00,000/- through E- Debit Card.

- Get the best of dining experiences with Rs.800* off & more via Axis Bank Dining Delights Program with EazyDiner

Open an ASAP Digital Savings Account to unlock exciting offers in just 4 Steps

- Best-in-class financial experts at your service handling your investment portfolio.

- Flat 60% discount on lockers, additional 10% through Family Banking.

- 12 complimentary access to specified airport lounges in India per year (3 per quarter) with Axis Bank Lounge Program.

- 12 complimentary rounds of golf lessons per calendar year.

- 4 complimentary rounds of green fee per calendar year.

- Avail the Buy 1 Get 1 offer to get up to 96 complimentary tickets across the year on BookMyShow.

- Purchase protection cover of ₹ 50,000, cumulative cover up to USD 500 for loss/delay in baggage and personal documents

- Get guaranteed 10% cashback every time you shop on Flipkart via Grab Deals.

- Get flat 10% cashback at every purchase on Amazon.in via Grab Deals.

- Avail 1% cashback on Online Spends through E-Debit Card. (*Click here to view excluded merchant categories)

- Milestone Benefits: Get 2000 EDGE REWARD points on annual spends of Rs. 1,00,000/- through E- Debit Card.

- Daily cash withdrawal of ₹ 3 lakhs and purchase limit of ₹ 6 lakhs

- Air accident insurance of ₹ 1 crore, personal accident insurance of ₹ 15 lakhs

T&C Apply

Accelerate your shopping with Instant Debit Card

The image for physical card is representative of easy variant. Actual image might be different basis your account selection

Control

your card

on the go

Instant

E-Debit Card

Buy 1 Get 1 on

Bookmyshow.com through

E-Debit Card

Avail 1% cashback

on Online Spends through E-Debit Card. (*Click here to view excluded merchant categories)

Up to 20% Off on 4000+

Partner Restaurants

Bank on India’s top rated Mobile Banking app

Trusted by 20 Million+

registered customer

Hyper personalised, intuitive & seamless

250+

Banking Services

One stop solution to your banking needs

100% Digital Account with no paperwork or branch visits

5100+ Branches

15000+ ATMs

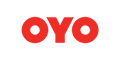

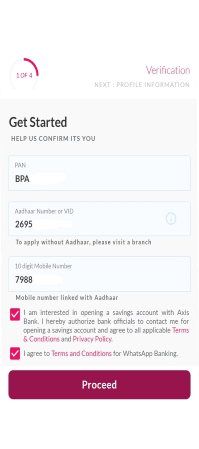

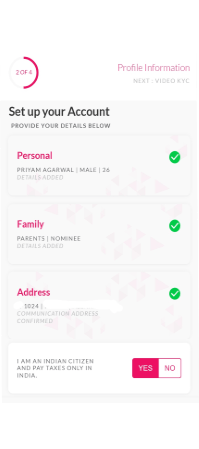

Video KYC Account in just 4 steps

Funding and Fees

| Amaze Digital Savings Account |

|---|

| Initial Funding: ₹10,000 | Average Balance Requirement |

| Debit Card fees: Nil | Average Monthly Balance - NIL |

| Plan Charges: Monthly: ₹200/month (6 months minimum) |

| Annual: ₹2,200/year |

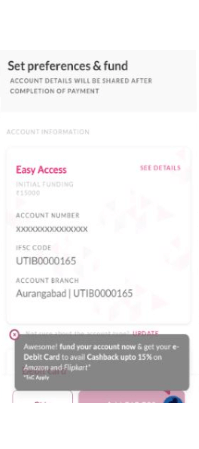

| Easy Access Digital Savings Account |

|---|

| Initial Funding: As Stated Below | Average Balance Requirement |

| Metro: ₹16000/- | Metro: ₹12000/- |

| Urban: ₹15000/- | Urban: ₹12000/- |

| Semi Urban: ₹6000/- | Semi Urban: ₹5000/- |

| Rural: ₹3000/- | Rural: ₹2500/- |

Virtual Debit Card fees : Nil

Physical Debit Card Joining Fees :500+GST

Physical Debit Card Annual Fees : 500+ GST

|

| Liberty Digital Savings Account |

|---|

| Initial Funding: ₹25,000/- | Average Monthly Balance - ₹25,000 OR monthly spends* of ₹25,000

*spends include merchant payments made through your account (internet banking, Axis Mobile, UPI) and through debit card of Primary Account Holder (offline or online payments) |

Virtual Debit Card fees : Nil

Physical Debit Card :1. Joining fees : ₹200 + GST

2. Annual fees : ₹300 + GST |

| Prestige Digital Savings Account |

|---|

| Initial Funding: ₹75,000/- | Average Monthly Balance - ₹75,000/- |

Virtual Debit Card fees : Nil

Physical Debit Card Annual fees : ₹500+GST

Physical DC joining Fees : Nil |

| Priority Digital Savings Account |

|---|

| Initial Funding: ₹2 Lakhs | Average Monthly Balance - ₹2 Lakhs |

| Debit Card fees: Nil |

| Burgundy Digital Savings Account |

|---|

| Initial Funding: ₹5 Lakhs | Average Quarterly Balance - ₹10 Lakhs |

| Debit Card fees: Nil |

GRAB DEALS round the Clock & Year!

Up to 20% cashback on 50+ partners

Access world class banking products under one roof

Awards and Accolades

Customer Appreciations

Pratyush Pathak

“UI is very impressive and user friendly. Security levels are also very effective. I really want to recommend this bank and application to everyone.”

-->

Manjeet Singh Narang

“Axis Bank Services are excellent. For the last year, I haven’t found a lapse on bank’s part. I recommend everyone to open their bank account in Axis Bank & take their services. Online services are much better than others.”

Samir Ganguly

“Hastle free & easy functioning app. Saves lot of time. Appears the system has further been simplified, helpful.”

Sandeep Dayal

“One of the best service provider in comparison to other banking applications, The interface is so simple and new update is really awesome.”

Kiran Kumar

“Excellent, thanks to Axis Bank. All my banking needs are done with this bank. Extremely happy for this. App new look is simply superb. Keep it up.”

Your Security, Our Responsibility

Blogs

Open a Bank Account digitally in just a few clicks

Axis ASAP: A digital savings account with loads of benefits

Calculate interest on Savings Account: Formula, example & types

Types of Savings Accounts: Know them all

Additional Offers

- Please click here for additional offers on Burgundy Savings Account.

- Please click here for additional offers on Priority Savings Account.

- Please click here for additional offers on Prestige Savings Account.

- Please click here for additional offers on Liberty Savings Account.

FAQs

General Queries

What is ASAP Digital Savings Account?

ASAP Digital Savings Account is the new age digital savings Account offered by Axis Bank. All you need is your Aadhaar, PAN & other basic details. Since this process is completed through a Video verification, kindly ensure you are using a camera enabled device.

Benefits of ASAP Digital Savings Account.

- No need to visit the Branch -Avail all our 250 + services online

- Begin safe transactions with your debit card, UPI, NEFT, IMPS, and RTGS as soon as you activate your digital Savings Account.

- Receive a virtual debit card loaded with promotions instantly when you open a digital Savings Account.

- Following the opening of your digital Savings Account, a physical debit card appropriate for your account type will be sent to your listed address.

- Signature Update via Axis Mobile app - Update any time after account opening.

Eligibility to open ASAP Digital Savings Account.

You can open an ASAP Digital Savings Account as long as,

- You are an Indian citizen.

- You have a valid PAN and Aadhaar number.

- You have a valid mobile number linked to your Aadhaar.

- You are 18 years of age or above.

- Your Desktop/Laptop or Mobile Device with which you are opening an account has a camera for the Video KYC process.

- You are applying from India.

Is it mandatory to share Aadhaar details to open a ASAP Digital Savings Account?

You need to voluntarily share your Aadhaar details to open an ASAP Digital Savings Account. In case you do not wish to share your Aadhaar or VID details, you may visit your nearest Axis Bank Branch and choose to open a savings account from our range of options.

Do I need to visit a branch after opening a ASAP Digital Savings Account?

You need not visit a branch post account opening. Your ASAP Digital Savings Account lets you avail all our 250 + services online.

Balance requirement for Digitally Opened Savings Account

You need to maintain account variant specific balances as given below:

- Easy Access Account: Rs.12,000 (Metro/ Urban) + Rs.5,000 (Semi-Urban) + Rs.2,500 (Rural)

- Liberty Savings Account: Rs.25,000(Metro/Urban) or spends of Rs. 25,000/-, Rs. 25,000 (Semi-urban/Rural – AMB or spends of 25,000/-)

- Prestige Savings Account: Click here

- Priority Savings Account: Click here

- Burgundy Savings Account: Click here

- Please refer to Fees and Charges tab to view area wise classification

Do I need to add a nominee for my ASAP Digital Savings Account?

It is always good to have a nominee for your account. In case of unforeseen circumstances, your account funds can be transferred to the nominee without any hassle. You can, however, skip nominee details while opening the account and add one later.

Can a Joint Account be opened under Digital Savings Account?

No, Joint Accounts cannot be opened under Digital Savings Account. Only Single Individual Accounts can be opened.

Onboarding Related

What is the maximum time within which I have to complete my application?

You need to complete first 3 steps of your application within 3 days (72 hours) from the time you completed your Aadhaar based OTP verification in Step 1. The 4th step related to funding can be completed within 72 hours from time of completion of VKYC (Step 3).

Will my account be activated immediately after I complete all 4 steps of the application?

Post successful completion of funding, your application will be processed, during which a backend verification is done. Duration of this verification process may vary from 1 hour to a few days, depending on various factors. In the unlikely event where you have not received an email confirmation from us regarding account activation even after 4 business days, please reach out to us via the call center numbers given here to check the status of your account.

How do I resume my application if I was not able to complete it the first time?

As soon as you complete Step 1, a link is sent on your registered mobile number. Click on this link to resume your account opening journey. Please note that the link will be valid only for 3 days (72 hours) for resuming journey to complete the process till Step-3. However, for Step-4, same link can be used for next 72 hours (from time of completing VKYC step) to complete funding. Post this time frame, you may start the journey again as a fresh application.

Is it possible to use an address different from the one on my Aadhaar for receiving communication?

Yes, at the time of applying for a ASAP Digital Savings Account, you can provide your communication address with a self declaration.

Can I specify a communication address that varies from my Aadhaar registered address?

Yes, at the time of applying for a ASAP Digital Savings Account, you can provide your communication address with a self declaration.

I completed VKYC for my account but I am unable to complete my application

If you've completed VKYC but not completed your funding step, we will keep your account in dormant stage for 72 hours till funding is completed. If funding is not completed within 72 hours from the time you completed yourVKYC ( Step- 3), your application will expire. You can then try applying for a fresh Digital SA account.

While funding the account, my account got debited. However, it says that the payment failed.

This happens when we do not receive a confirmation of the payment from the payment gateway. In such a scenario, the amount will be refunded to your account within 3-7 working days. You may initiate a fresh transaction to complete the account opening journey.

My application was rejected in Video KYC, am I eligible to apply again?

Yes, you may apply for a ASAP Digital Savings Account again.

How can I upload my signature for this account?

You may upload the signature during the VKYC step. You need to sign on a white sheet of paper and show the same to the VKYC agent. Alternatively, you may upload the signature after completing the journey in the Axis Mobile banking app.

Debit Card Related

Which debit cards will I get with my ASAP Digital Savings Account?

You will receive,

- A Visa E-Debit Card (which is a virtual Debit Card) instantly on account opening. This will be shared on your registered email ID. You may start transacting with this card immediately, post account activation.

- Physical Debit Card as per account variant will be dispatched to your communication address post account activation. You may transact with both Debit Cards.

- Easy Access Savings Account holders will receive their Visa Online Rewards Debit Card

Prestige Savings Account holders will be eligible for a Prestige Debit Card

Priority Savings Account holders will be eligible for a Priority Platinum Debit Card

Burgundy Account holders will be eligible for a Burgundy Debit Card

For Liberty Scheme it is Liberty Debit card

How do I earn reward points on my Debit Cards?

To know more about EDGE REWARD point earn structure Click here

What is a virtual Debit Card? What are the offers and benefits?

- The E-Debit Card is a virtual Debit card that comes loaded with a host of offers and benefits that you can view here

- It provides easy and secure online transactions and does not have any plastic existence.

- It can be used to register for Axis Mobile App. Once registered, you may view details such as your 16 digit card number, expiry date and CVV via the App.

- You receive your E-Debit Card immediately on account opening.

Benefits of Physical Debit card

Daily transaction limits for my Debit Cards.

- The Virtual Debit Card will have an e-commerce transaction limit of Rs. 1,00,000/- per day.

- The Visa Online Rewards Debit Card has a transaction limit of Rs.5 lakh per day.

- Prestige Debit card has an ATM limit of Rs. 1,00,000/- & POS limit of Rs. 5,00,000/-

- The Priority Debit Card has a transaction limit of Rs.5,00,000/- per day. The Burgundy Debit Card has a transaction limit of Rs. 6,00,000/- per day.

For Liberty Debit card

- Daily withdrawal limit: Rs. 50,000

- Daily Post Limit is Rs. 3,00,000

- You may modify this limit by login in to Internet Banking or through Axis Mobile app.

Delivery of physical Debit Card.

The physical Debit Card as per account variant will be delivered to your communication address within 7 working days from the time of account activation. If you have not received it please reach out to us here for resolution. However, with the special circumstances that we are currently facing nationwide, some delay in delivery may be expected.

How is a Virtual Debit Card different from a physical Debit Card?

You may use your Visa E-Debit Card (virtual) only for online transactions like shopping, travel, recharge, transferring funds etc. You may also use it to withdraw cash at ATMs that have cardless withdrawal facility.

You may use your physical Debit card for online transactions, offline transactions at merchant POS and cash withdrawals at any ATM.

Can I use both Virtual as well as Physical Debit Card?

Yes, both the Debit Cards (Visa E-Debit Card and Physical Debit card) that come with your ASAP Digital Savings Account will remain active for usage.

Where can I find details of my virtual Debit Card?

You can find the details for your Virtual Debit Card using the Axis Mobile App. Please follow the below steps:

- Login to Axis Mobile App >> Accounts >> Click on Your ASAP Digital Savings Account No. >> View Debit Card Details

- You might also look in the email inbox linked to your account to find your virtual card information, which would have been included with the initial welcome or activation communication.

What is the validity of Virtual Debit Card?

Your Virtual Debit Card is valid until the expiry date mentioned on it.

How do I generate a Debit Card PIN for virtual Debit Card if I did not generate it during the application process?

The process applicable for both the E-Debit card and Physical Debit Card, is via Phone Banking.Alternatively, you may set the PIN for your Physical Debit Card via any of the other options. View all options here.

How do I place a request for replacement/Upgrade of Debit Card.

You may apply for a replcement or upgrade of your Physical Debit Card via the below steps.

a. Axis Mobile App : Click on Banking >> Services >> Debit Cards >> Upgrade >> Select the Card

b. Internet Banking: Select your Debit Card through My Debit Cards under the Accounts option >> Select between Block / Replace / Upgrade & the card you wish to upgrade to >> Enter code received through SMS.

c. Call : Call us on the numbers mentioned here.

d. Branch : You can visit your nearest Axis Bank branch & place a request to get a physical Debit Card for your Savings Account.

e. Burgundy customers can call us on - 18004190065

Mobile Banking Internet Banking

How do I begin using Internet Banking for my ASAP Digital Savings Account?

Post account activation, you can register for Internet Banking by:

a. Directly logging in using your ASAP Digital Savings Account’s Virtual Debit Card details.

b. Registering as 'First time user' on Internet Banking and using your Customer ID.

How do I begin using Mobile Banking for ASAP Digital Savings Account?

You can register for Axis Mobile using your registered mobile number. You will need to authenticate yourself using details of either of your Debit Cards before initiating any financial transactions.

You can register for Axis Mobile using your registered mobile number. You will need to authenticate yourself using details of either of your Debit Cards before initiating any financial transactions.

Cheque Book related

Will I receive a Cheque Book for the ASAP Digital Savings Account?

You need to update the Signature in your account to be eligible for a cheque book. You may update your signature through Mobile app> Insta Services or you may visit your Axis Bank branch to place a request to get your signature updated in the Bank's records. Once the Signature is updated in your Savings bank account, you can place the request for a cheque book.

How do I request for a Cheque Book for my ASAP Digital Savings Account?

A cheque book can be issued for your ASAP Digital Savings Account only after you have updated your signature in your account. Once the Signature is updated, you can place a request using the below options:

a. SMS - SMS space to 56161600 from your registered mobile number. (For e.g. – CHQBK 23456)

b. Axisbank.com/Support: Support Home Page >> Get It Done Instantly >> Click on Cheque Book Request >> Enter Registered Mobile Number >> Enter OTP >> Select Account >> Click on Submit >> Cheque Book will be issued and delivered. (You can also scroll up and click on ‘Request Using Registered Mobile No.’ tab to use this option)

c. Chat with Axis Aha!: Click on Axis Aha! icon below or on axisbank.com >> Type “Order Cheque Book” >> Login with you Internet Banking credentials or MPIN >> In case of multiple accounts, select the account for which you need to order the cheque book for >> Verify your details and click on “Confirm” >> Enter the OTP received on your registered mobile number >> Your cheque book will be ordered

d. Axis Mobile App - Select Banking >> Click on Services >> Click on Savings / Current Account >> Click on New Cheque Book.

e. Internet Banking – Home >> Services >> Cheque Services >> Select Request Cheque Book >> Select Account Number & No. of Leaves >> Enter NetSecure Code received through SMS

f. ATM - Visit your nearest Axis Bank ATM Please note charges will be applicable for a cheque book as per the Savings Account type selected.

Charges for availing a Cheque Book for ASAP Digital Savings Account.

Click here to know all applicable charges for using ATMs.

Updation of details

How do I update my signature in my ASAP Digital Savings Account?

You can update your signature using these methods:

a. Axis Mobile App: Click on 3 bar menu >> Services & Support >> Insta Services >> Accounts >> Update ASAP Digital Savings Account signature >> Agree to terms and conditions >> Upload documents >> Update >> SR number is populated.

Document : Signature on white paper with black or blue ink.

b. Branch Banking : You can place a request by visiting your nearest Axis Bank Branch.

How do I update details for my ASAP Digital Savings Account?

You can update your information via the Axis Mobile App, Internet Banking or by visiting any Axis branch.

Grab deals related

What are the various products / services offered on Grab Deals?

The platform has partners across various categories to provide exclusive cashback offers for Axis Bank customers when they shop using Axis Bank credit and debit cards. To know more about our new and updated partners and their offers on the on-going basis, visit our portal axisbank.grabdeals.com

What are special offers for ASAP Digital Savings Account holder?

- Flat 10% cashback* on Flipkart & Amazon.in with Easy Access, Liberty, Prestige, Priority & Burgundy Digital Savings Account via GRAB DEALS

How to purchase a product via Grab Deals?

- Enter your mobile number and card information (last 4 digits) on the page when prompted

- Browse the offers at Grab Deals & choose the merchant of your choice

- Proceed to the merchant’s site via our portal and shop

What kind of offers are available on Grab Deals?

Cashbacks : When you shop via Grab Deals using Axis Bank credit or debit cards, you will get exclusive cashbacks at various partners listed on Grab Deals site.

How long will it take to get the cashback?

Your cashback would be processed between 90 - 120 days from the transaction date.

Is there any limit on the amount of cashback that one can avail?

Yes, you can avail a maximum monthly combined cashback per account of Rs. 1000 for Easy Access, Prime, Liberty, Prestige, Priority & Burgundy Digital Savings Account.

If I have coupon code or extra discount offers on the partners, will I still get the cashbacks?

Yes. The cashback will be calculated on final amount paid at the partner site after coupon code/instant discount offers are applied.

Fees and Charges

Please click here to know about the fees and charges for your desired product.

Terms and Conditions

General Terms and Conditions

- Any Resident Indian who is 18 years and above who provides his/her details in the ASAP Digital Savings Account application for opening Axis Bank account offered by Axis Bank Limited is a Customer

- By initiating the journey and providing his/her details, customer agrees to the terms and conditions of the Bank as listed in https://www.axisbank.com/docs/default-source/default-document-library/wef-1june-2020.pdf

- By initiating the journey and providing his/her details, customer agrees to the terms and conditions of the Bank as listed in https://www.axisbank.com/docs/default-source/default-document-library/debitcard_mitc.pdf

- By visiting the Axis Digital Account Opening – Apply Now link and sharing all information, customer consents to provide his/her name, contact details and other information on an at will basis with Bank.

- Customer authorizes Axis Bank to call on the given number to explain the features of the product

- Bank shall not be liable for any connectivity/ signal/ data issues leading to non-completion or wrong/false/incomplete information being provided by the customer leading to the incompletion of his/her application.

- The customer herewith agrees to provide his/ her valid Aadhaar number and valid PAN Card details. He/she understands that opening an account is subject to correct, complete and accurate information is provided.

- Customer agrees that upon successful OTP validation of Aadhaar, the name of the customer in the account will be the same name as appearing in his/her Aadhaar Card

- Application once submitted cannot be withdrawn by the customer. Bank shall not be liable to pay for any costs (technical/ data plan related or otherwise) incurred by the customer in the course of the downloading or sharing of his/her details on the application.

- The customer herewith agrees to provide the accurate documentation and information as listed in the app for the purpose of account opening. Customer understands and agrees that failure to provide requisite documentation and information shall result in rejection of application by the Bank. The customer agrees that Bank has every right to reject the account opening application, if there is any erroneous, incomplete or misleading information provided by the customer or for any other reason whatsoever with/without assigning any reason or if KYC documents submitted do not comply with the KYC norms of the Bank.

- This account opening process is also not available for customers who are FATCA reportable. Such customers are requested to approach the branch and to comply with requirement of opening an account.

- Bank reserves the right to take necessary action, legal or otherwise, if it finds any wilful modification/ withholding of information or misrepresentation by the customer.

- Customer understands and agrees that interest on the amount funded online will be paid subject to activation of the account and only from the date when the funds has been credited into the account.

- The customer shall not enjoy the services provided by the bank unless the customer on-boarding process is complete.

- Customer declares and confirms that the Bank shall be entitled to rely on all/any communication, information and details provided on the electronic form and all such communications, information and details shall be final and legally binding on the Customer.

- Customer understands and confirms that the Bank has every right to close or debit freeze the account, if the details provided by him/her are found to be inaccurate, incorrect or false by the Bank or for any other reason whatsoever without assigning any reason thereof. In such an event, the bank shall not be liable to pay any interest on the amount of deposit & the refund of amount deposited in the account will be refunded to the source account/or issue a Demand Draft to the Customer. In such an event, bank will retain the documents / Photographs (if any) and any other signed document submitted.

- This application is available for opening a savings account by Resident Indian Individuals only.

- Customer gives consent to the Bank to fetch his/her demographic details from Unique Identification Authority of India (UIDAI), using biometric authentication which will be used for KYC purposes. The demographic details include name, DOB, Father’s Name, gender, address and photograph. Customer further consents to the Bank to fetch his/her contact details from UIDAI which includes the contact number and email ID.

- Customer authorises Bank to link the Tokenized Aadhaar number provide with the savings account opened by them under this process.

- The Bank reserves the right to cancel the Customer ID and Account Number (A/C) allotted to the customer, if the customer does not complete the verification process within the allotted time.

- The Bank reserves the right to hold the accounts in Debit Freeze or close the Account even after account activation in case of any discrepancy found as part of regular monitoring and document verification activities.

- The customer agrees to provide the necessary details (Location, Mobile, Email etc.,) as per his/her requirement at the time of submission of details through the app. Bank shall not bear any liability for any loss arising out of customer’s failure to do so.

- The customer herewith agrees that if the application is rejected, Bank will retain the documents / Photographs and any other signed document submitted by the customer on the Web app or otherwise.

- Customer confirms to have read, understood and will be bound to/ abide by the Terms and Conditions of account opening and the general terms applicable to account as available on Axis Bank’s website

- Customer should also ensure that his/her signature is duly updated in the Bank's records in order to issue ECS/NACH/Direct debit mandate on ASAP Digital Savings Account.

- Customers can update their signature through the Mobile Application or by visiting any of the nearest Axis Bank branch. Accounts with signature enables you to issue NACH/ECS/Direct Debit mandate

- The Customer herewith undertakes to complete his full KYC by undertaking a video based KYC validation process.

- The Customer undertakes to complete video KYC process within 72 hours post funding and in case of his/her fails to complete the same for any reason whatsoever Bank shall have exclusive discretion to close his/her account and the amount deposited by Customer for funding the account would be refunded into the bank account/debit card/upi address used by the Customer in the initial funding transaction process.

- The Customer agrees that if her/ his balance in the account will be put under a total freeze, till such time the Customer completes the full Video KYC process and fulfills the internal audit requirements. In case of account being put under total freeze, the customer agrees that principal amount on such deposits kept along with the interest accrued (if any) will be payable to him only upon completing his Video KYC process and successful internal audit.

- The Customer agrees and undertakes that if Customer could not complete his/her Video KYC validation process or the said process if dropped midway due to technical, systematic or server errors/issues or other operational issues in that case Customer will be permitted to complete Video KYC process again to enable the Customer to have his/her account opening process completed. Customer also agrees and undertakes that even if Customer completes his/her Video KYC process for account opening but Bank unable to access the KYC validation data/information collected under Video KYC process due to some technical, systematic or server errors/issues, or any other issue which are beyond the control of the Bank, in that case Bank has exclusive right to ask Customer to visit its nearest branch or RM for undertaking physical KYC validation process for completion of his/her account opening process.

- The Customer agrees and acknowledges that, the Bank shall not be held liable or responsible in any manner whatsoever in respect of any loss, cost or damage incurred by Customer due to any technical, systematic or server errors/issues, or any other issue occurred while undertaking Video KY process, which are beyond the control of the Bank or any costs (technical/ data plan related or otherwise) incurred by the Customer.

- In case the mode of operation is ‘Either or survivor’ or “ Former or Survivor” or “Anyone or Survivor”, in the event of the death of one of the deposit holder, premature withdrawal is required by the survivor: In the event of the death of either one of us, the survivor, if he / she so request the bank, to prematurely withdraw the said deposit without seeking the concurrence of the legal heirs of the deceased joint deposit holder, the bank is entitled to honour the same. We further affirm that payment of the proceeds of such deposit to the survivor represents a valid discharge of the bank's liability provided.

- i. There is no order from a competent court restraining the bank from making the payment from the said account.

- ii. That the survivor would be receiving the payment from the bank as a trustee of the legal heirs of the deceased depositor and that such payment to him/her shall not affect the right or claim that any person/s may have against the survivor to whom the payment is made.

- Where the deposit is held singly and premature withdrawal is required by the nominee in the event of death of the deposit holder:

- i. In the event of my death, the nominee named for the deposit is entitled to prematurely withdraw the said deposit, if he/she so requests the bank, without seeking the concurrence of my legal heirs. I further affirm that payment of the proceeds of such deposit to the nominee represents a valid discharge of the bank's liability.

- ii. That the nominee would be receiving the payment from the bank as a trustee of the legal heirs of the deceased depositor and that such payment to him/her shall not affect the right or claim that my legal heirs may have against the nominee to whom the payment is made.

- Click here for general T&C for Burgundy

- Click here for general T&C for Priority

Savings Account is offered subject to the fulfilment of the Product eligibility criteria, applicable to all existing and new customers under the Priority scheme.

- Customers who do not qualify the above criteria will be converted to normal savings account with due notice. Fees and charges will apply accordingly (Including annual debit card charges)

- All accounts have monthly billing cycle in a year i.e. 1st to 30th / 31st of the month.

- There will be a fee of Rs.500 if the account is closed between 14 days and 1 year of account opening. No fees would be levied if account is closed within 14 days of account opening or after 1 year.

- Axis Bank reserves the right, at its own discretion, to close the account in case initial funding is returned/bounced and funding as per scheme code is not received within 30 days of account opening

- The Bank can at its sole discretion discontinue any service partially / completely or change fees by providing 30 days’ notice. All revision in fees will be displayed on the Notice Board of the branches of Axis Bank and also on our website www.axisbank.com.

- GST as applicable will be levied on all fees.

- Aadhar Number should be updated in your bank account to receive subsidies directly from Government (LPG, MGNREGA, etc.)

- If your account has been opened in conjunction with an Axis Bank loan, with a standing instruction for repayment of the loan, your account will be a zero-balance account till such time as the loan continues and the SI stands, after which, the balance requirement will apply.

Digital Savings Account opening for existing to bank customers:

Terms and Conditions for an existing Customer:

1. As an existing customer, I understand that I have a valid and active relationship with the Bank, and I have applied for a Digital Savings Account.

2. Customer, with full awareness and liveliness, acknowledges and consents to allow the Bank to use the existing active KYC details for the limited purpose of opening the Digital Savings Account without having to perform the video KYC process during the digital account opening journey.

3. Customer understands that he/she can apply for the Digital Savings Account through the following means:

a. Redirection from a Parent Product Journey: The customer who reaches the Digital Savings Account opening journey by completing the KYC process with the Bank successfully through a prior loan or credit card or other product application will be eligible to skip video KYC during Digital Savings Account opening journey. In such a case, the customer understands and affirms the following:

- i. Digital Savings Account with Axis Bank will be activated post successful activation of credit card / loan or any other parent product application (where I had completed my KYC process successfully)

- ii. I have carefully read the terms and conditions and willingly declared my personal and demographic details such as family, communication, nominee, and occupation details correctly during my credit card / loan or any other parent product application (where I had completed my KYC process successfully) and understand that I will not be able to change my personal or demographic details during my Digital Savings Account journey.

- iii. In case of any changes in existing personal or demographic details, I agree to promptly inform the Bank about the same and proceed to open Digital Savings Account through assisted mode. Accordingly, I will not be able to proceed with Digital Savings Account opening and will have to visit the nearest branch to open a savings account with the Bank.

- iv. In case my credit card / loan or any other parent product application (where I had completed my KYC process successfully) is rejected or not activated within 10 days, initial funding amount will be refunded to my original payment source within 15-17 working days (under normal circumstances).

4. Customer agrees and allows the Bank to deduct his/her account balance for the purpose of initial funding of Digital Savings Account.

5. Customer understands that the initial funding amount debited will be on hold interest free till the Digital Savings Account is activated.

Terms and Conditions for Debit Card

Please click here for Debit card related terms and conditions

Aadhaar related Terms and Conditions

1. Customer understands that he/she has no objection in authenticating themself with Aadhaar based authentication system and voluntarily consent to providing their Aadhaar number, Biometric and/or One Time Pin(OTP) data (and/or any similar authentication mechanism) for the purposes of seeding their new account with NPCI mapper to enable me to receive Direct Benefit Transfer (DBT) including LPG Subsidy from Govt. of India (GOI) their my new account.

2. I hereby state that I have no objection in authenticating myself with Aadhaar based authentication system and consent to providing my Aadhaar Number, Biometric and/or (One Time Pin) OTP data (and/or any similar authentication mechanism) for Aadhaar Based authentication for the purposes of availing of the Banking Service from Axis Bank.

3. I understand that the Biometric and/or (One Time Pin) OTP (and/or any similar authentication mechanism) I may provide for authentication shall be used only for authenticating my identity through Aadhaar Authentication system for that specific transaction and for no other purposes. I understand that Axis Bank shall ensure security and confidentiality of my personal identity data provided for the purpose Aadhaar based authentication.

4. I submit my Aadhaar number and voluntarily give my consent to:

- Use my Aadhaar Details to authenticate me from UIDAI.

- Use my Registered Mobile Number in the bank records for sending SMS alerts to me.

- Link the Aadhaar Number to all my existing/new/future accounts and customer profile (CIF)with your Bank.

I understand that my information submitted to the bank herewith shall not be used for any purpose other than mentioned above.I hereby declare that all the above information voluntarily furnished by me is true, correct and complete.

5. The bank may disclose information about customer's account, if required or permitted by law, rule or regulations, or at the request of any public or regulatory authority or if such disclosure is required for the purpose of preventing frauds, or in public interest, without specific consent of the account holder/s.

6.If in case the customer do not wish to open the account through Aadhaar based authentication process, the customer can open an account by submitting physical account opening form along with his full KYC documents by visiting the nearest Axis Bank branch.

Video KYC related Terms and Conditions

1) I hereby state that I have no objection in authenticating myself with video based customer identification process (“V-CIP”). Further, I expressly consent to and authorise the Bank (whether acting by itself or through any of its service providers, and whether in automated manner or otherwise), to do and undertake any of the following, in relation to my application details including my photograph, personal data and sensitive information about me, information, papers and data relating to know your customer (KYC), credit information, and any other information whether about me or not as may be deemed relevant by the Bank (collectively, “Information”) for the purposes of (“Purposes”) via V-CIP:

a. to use devices and/or software, including the app, to record and capture my Information, interactions inclusive of video and which will be used for the Information verification and Purposes;

b. to collect the Information from me and other physical or online sources including accessing the same from credit information companies, information utilities, websites, data bases and online platforms (whether public or not); to get the authenticity, correctness, adequacy, etc. of the Information verified from any sources and persons including from online data bases; and to act for and on my behalf for such accessing, collecting or verifying of the Information including using my log in and password credentials on the online platforms; such collection, access and verification may be done without any notice to me;

c. process Information including by way of storing, structuring, organising, reproducing, copying, using, profiling, etc. as may be deemed fit by the Bank;

d. to store the Information for such period as may be required for contract, by law or for the Bank’s evidential and claims purposes, whichever is longer;

e. to share and disclose the Information to service providers, consultants, credit information companies, information utilities, other banks and financial institutions, affiliates, subsidiaries, regulators, investigating agencies, judicial, quasi-judicial and statutory authorities, or to other persons as may be necessary in connection with the contractual or legal requirements or in the legitimate interests of the Bank or as per the consent;

f. any of the aforesaid may be exercised by the Bank for the purposes mentioned above, for the purposes of credit appraisal, fraud detection, anti-money laundering obligations, for entering into contract, for direct marketing, for developing credit scoring models and business strategies, for monitoring, for evaluating and improving the quality of services and products, for other legitimate purposes or for any purposes with consent.

I hereby state that I have no objection in authenticating myself with Aadhaar based authentication system and consent to providing my Aadhaar Number, Biometric and/or (One Time Pin) OTP data (and/or any similar authentication mechanism) for Aadhaar Based authentication for the purposes of availing of the Banking Service from Axis Bank.

I understand that the Biometric and/or (One Time Pin) OTP (and/or any similar authentication mechanism) I may provide for authentication shall be used only for authenticating my identity through Aadhaar Authentication system for that specific transaction and for no other purposes. I understand that Axis Bank shall ensure security and confidentiality of my personal identity data provided for the purpose Aadhaar based authentication.

I submit my Aadhaar number and voluntarily give my consent to:

2) I expressly agree to and subject me to the automated processing, automated profiling and to the automated decision making by or on behalf of the Bank.

3) I expressly agree to the Bank and/or its affiliates for using the Information and for cross-selling to me their various products and services from time to time.

4) I hereby confirm that I have read and I hereby accept the Privacy Policy of Axis Bank Limited (“Bank”) available at.

Insurance related Terms and Conditions

Please click here for Insurance related terms and conditions

- The debit card entitles you to a Personal Accident Insurance Cover. The insurance cover will be considered as active at the time of the incidence if you have made a successful purchase transaction on your card within 90 days prior to the occurrence of the incident. The incidence has to be reported within 50 days of occurrence.

Privacy Policy

Please click here for Privacy Policy

Grab Deals Terms & Conditions

These terms and conditions (“Terms”) shall be applicable to the User (as defined hereinafter) participating in the Offer (as defined hereinafter) who agrees to be bound by the same and shall regulate the provisions of the specified products and services provided by Axis Bank Limited ("Axis Bank"). Any User participating in the Offer shall be deemed to have read, understood and accepted these terms and conditions and these Terms shall be in addition to and not in derogation of other applicable terms and conditions of any account or any other facility/services offered by Axis Bank and/or such other terms and conditions as may be specified by Axis Bank.

Definitions:

The following words and phrases shall have the meanings set out herein below in this document unless repugnant to the context:

“User" shall mean a person who is an Axis Bank savings account holder or an Axis Bank credit card holder and who shops via Grab Deals platform.

“Offer" shall mean the cashbacks or reward points that Axis Bank will provide the User upon successfully completing transactions via grabdeals.axisbank.com basis certain conditions listed under Terms of Offer below.

“Affiliate" shall mean the merchants/brands listed on Grab Deals platform.

Axis Bank Grab Deals is a platform only for display of offers extended by Affiliate/(s) to the User/(s). Axis Bank is hosting the Grab Deals platform purely for the convenience of its User’s to display the offers extended by Affiliate/(s) to the User/(s) . The products/services are being offered solely by the Affiliate/(s) and Axis Bank is not selling/rendering any of these products/services. Axis Bank is not undertaking the business of on-line retail trading or shopping by hosting the Grab Deals platform. Axis Bank will not earn any commission or any other fee upon its User/(s) viewing the offers made available by the Affiliate/(s) or purchasing/ availing of a product/service offered by the Affiliate/(s), except the customary considerations for use of credit card/debit cards/net banking facility. The User/(s) is free to purchase/avail them from any other stores/online platforms and by using any other payment mechanism. Axis Bank is merely facilitating the payment to its User/(s) by providing the Payment Gateway Services. By hosting the Grab Deals platform, Axis Bank is neither guaranteeing nor giving any warranty nor making any representation with respect to the offers made by the Affiliate/(s). Axis Bank is neither endorsing the Affiliate/(s) or any product/service nor is it responsible for sale/quality/features of the products/ services under the Offer. Any Information on the Axis Bank Grab Deals website (or the section thereof to which you will be directed) whether about the the Affiliate/(s)t or the products/services being offered have not been verified by Axis Bank. Axis Bank shall not be liable or responsible for any such information. Axis Bank will not bear any obligation or liability if a User purchases/avails of a product/service under an offer. If you choose to avail of the purchase/avail of a product/service, Axis Bank will neither be a party to nor in any manner concerned with such purchase/availment nor be liable or responsible for any act or omission of the Affiliate or the User. All product/service related queries/complaints will be addressed by the respective Affiliate only.

The website www.grabdeals.axisbank.com is powered and maintained by Vernost Marketing Technology Solutions Pvt. Ltd (“Vernost”) on behalf of Axis Bank, a company incorporated and existing in accordance with the laws of India. The following terms and conditions apply to all visitors or Users of this Website. Please read these site Terms and Conditions carefully before using this website. By accessing or using this website you explicitly agree to comply with and be bound by these site Terms and Conditions. When you access any of the sub-Site (whether belonging to an ‘associate’ of Company or otherwise) through this site, then the sub-site may have its own terms and conditions, which are specific to such sub-site.

These Terms and Conditions of use and any additional terms posted on this site together constitute the entire agreement between Company and you with respect to your use of this site.

TERMS OF OFFER

- The offer is valid only for Axis Bank account holders and Axis Bank credit card holders.

- This offer is applicable to the user only if the user had transacted using the Axis Bank credit or debit card (specified by the user at the authentication page) on the affiliate’s site. If the user had transacted using any other card (other than the one which was specified by the user at the authentication page), the cashback/reward points will not be applicable.

- Offer valid only for Axis retail customers. Any transaction done via businesses/ business correspondents or suspicious transactions shall not be eligible.

- The maximum cashback that the User can get by transacting via Grab Deals platform is Rs. 1000/- per account/credit card per calendar month.

- The cashback will be credited to User’s original mode of payment (debit or credit card) within 90 to 120 days from the date of transaction.

- The offer will be applicable only for one mobile phone purchased (per debit or credit card), on any Affiliate. This offer is not applicable to the second mobile purchased in that calendar month. In case the User purchases two mobile phones via Grab Deals platform, the offer will be applicable only for the first mobile purchased (across all Affiliates).

- By participating in this Offer, User agrees to be bound by the terms & conditions of this Offer including any other applicable terms & conditions modified and prescribed by Axis Bank from time to time. Any such participation by the user shall imply that the User has read, understood and accepted the Terms and Conditions hereunder.

- Cashbacks/Reward Points on Axis Bank Debit & Credit cards is only on items added to cart on the Affiliates immediately after landing from the Axis Bank Grab Deals. The offer will NOT be applicable on items that were already in the User’s cart (added during a previous session) but need to be added post landing from the Axis Bank Grab Deals platform only.

- This Offer is non-transferrable to any other person and cannot be exchanged with any other offer.

- This Offer is not transferable, non-assignable, and non-negotiable and cannot be en-cashed or clubbed with any other offer of Axis Bank.

- In all matters relating to the Offer and these terms & conditions, the decision taken by Axis Bank will be the final decision, which will be binding on the User.

- The Terms and Conditions of the campaign/Offer shall be in addition to and not in substitution/ derogation to the primary terms and conditions governing the usage of the services offered by Axis Bank.

- Any User/(s) participating in this campaign/Offer shall be deemed to have read, understood and accepted these Terms & conditions.

- The participation in the Offer is entirely voluntary and it is understood, that the participation by the User/(s) shall be deemed to have been made on a voluntary basis.

- Axis Bank shall in no way be liable if any User/(s) is/are unable/fail to do the transaction due to incompatible Mobile Phone handsets, Telecom Usage Plans or network failures or system failure/error or for any other reason whatsoever.

- Axis Bank reserves the right to, without liability or prejudice to any of its other rights, at any time, without previous notice and from time to time, withdraw/suspend/amend/cancel this Offer, without assigning any reasons thereof.

- Axis Bank will not be responsible or liable in case the Offer is not configured or could not be availed due to malfunction, delay, traffic/congestion on any telephone network or line, computer online system, servers or providers, mobile handset, computer equipment, software, or website. User cannot claim any loss, cost or damages from Axis Bank which may arise due to these technical reasons.

- All taxes, duties, levies or other statutory dues and charges payable in connection with the benefits accruing under the Offer shall be borne solely by the account holder and Axis Bank will not be liable in any manner whatsoever for any such taxes, duties, levies or other statutory dues.

- Incomplete / rejected / invalid / returned /disputed or unauthorized/fraudulent recharges or transactions will not be considered for the Offer.

- These Terms and Conditions shall be governed by the laws of India. The courts at Mumbai shall have the exclusive jurisdiction in respect of any disputes with respect to all the subject matter with relation to the Offer.

- Offer and these terms and conditions and an arrangement herein shall be subject to applicable RBI guidelines issued from time to time and prevailing law and regulations. This Offer is / would be modified / discontinued based on the prevailing law / regulation at any point of time and neither party shall be under any liability or obligation or continue implementation of the said Offer till such time the terms are modified by the parties as per the prevailing/ amended law at that point of time. In the event, that the Offer cannot be continued without total compliance of the prevailing law at any point of time, this Offer shall be deemed to be terminated forthwith from the date when the amended law restricting / prohibiting the Offer comes into force.

- Axis Bank reserves the right to modify/ change all or any of the terms and conditions contained herein as per its discretion without assigning any reasons or without any prior intimation/notice whatsoever. Axis Bank also reserves the right to discontinue the Offer without assigning any reasons or without any prior intimation whatsoever. Axis Bank will not be liable in any manner whatsoever for any loss/ damage /claim/injury that may arise due to withdrawal or change in the terms and conditions of the Offer or discontinuation of it.

- For any queries pertaining to the cashbacks or reward points given by Axis Bank through the Offer, the User should get in touch with Axis bank call center: 1800-209-5577.

- The Offer is not available wherever prohibited and/or on products/services for which such offers cannot be made available for any reason whatsoever. The Offer is void where prohibited by law.

- User/(s) whose account is not active and/or are blocked/closed or have a credit freeze will not be eligible for the benefits of this campaign/Offer.

- This Offer is only valid for User/(s) who are Indian citizens.

- This Offer is not applicable for Non Resident Indian User/(s).

- Axis Bank reserves the right to disqualify the User from the benefits of the Offer if any fraudulent activity is identified as being carried out for the purpose of availing the benefits under the Offer or otherwise for any reason whatsoever. In case of any fraudulent activity, for the purpose of availing the benefits under the Offer, necessary action will be taken by the Bank. Please note Bank’s discretion in this regard shall be final and binding.

- User/s whose account has been classified as delinquent before or during the validity of the offer period will not be eligible for the benefits of the Offer. Bank’s discretion in this regard shall be final.

- Axis Bank is not responsible for any errors and/or omissions in the terms and conditions contained herein. All information is provided on "as is" basis without warranty of any kind. Axis Bank makes no representation and disclaims all express, implied, warranties of any kind to the User/(s) and/or any third party including, without limitation, warranties as to accuracy, timeliness, completeness, merchantability, or fitness for any particular purpose.

- Axis Bank/ Vernost reserves the right to undertake all necessary steps to ensure that the security, safety and integrity of Company's systems as well as its clients and users interests are and remain, well-protected. Towards this end, Vernost may take various steps to verify and confirm the authenticity, enforceability and validity of orders placed by you.

- Grab Deals reserves the right to introduce new products and replace the existing ones at any point in time without prior intimation to the member.

- Clubbing of this Offer with any other cashbacks/reward points/discounts (existing or new) is at bank’s discretion. Axis Bank reserves the right to add or remove any such cashback/reward points/discounts along with this offer.

- The User/(s) agrees to indemnify and keep Axis Bank indemnified for any loss or damage that Axis Bank may suffer with respect to the Offer including but not limited to any fraudulent and/or illegal transaction or any misrepresentation made by the User/(s) r while participating in this Offer.

In the event of any conflict or inconsistency regarding any instructions and conditions on any advertising or promotional material relating to the Offer, these Terms and Conditions shall prevail over all such other instructions and conditions and failure by Axis Bank to enforce any of its rights at any stage does not constitute a waiver of those rights.

1% cashback offer on credit card bill payment through Digital Savings account: Terms & Condition

- Only the Customers opening the digital savings account with Axis Bank (‘Account’) from the campaign and using the opened Account to do the Axis Bank’s credit card bill payments are eligible for the 1% cashback offer (‘Cashback Offer’). To avail the Cashback, Customer has to pay the credit card bill of the Axis Bank credit card owned by them.

- Credit card bill payment of any other customer would not be eligible for the Cashback Offer.

- Customer can avail monthly cashback up to Rs. 500 for 3 consecutive credit card billing cycle from the next month of Account opening. For example: If the account is opened in May 2024, Customer can avail the Cashback Offer for credit card bill payment in June, July and August 2024.

- The Cashback is applicable for the credit card bill payments done through Pay Now, Pay My Dues and Auto Pay mode of payment in the Axis Bank mobile app/Axis Bank internet banking. These payment methods can be used via Mobile App and Internet banking of Axis Bank.

- The Cashback will be processed and credited to Customer’s credit card in first week of next month. For example: Credit card bill payment done in May 2024 would be credited in the Customer’s credit card in the first week of June 2024.

- The Cashback Offer described above shall be applicable to Indian residents only.

- The benefits of Cashback Offer will be credits to any one of the credit cards only even if the Customer has effected bill payment for multiple credit cards from the Account.

- This is a limited period Cashback offer till 31st March 2025 and Axis Bank reserves the right to revoke/modify/cancel the Cashback offer at any time. It is clarified that the Customers who have availed the Cashback offer prior to any revocation/modification/cancellation will not be affected by the changes made to the Cashback offer subsequently.

INFINITY Savings Account : Terms & Conditions

1. New onboarding for Infinity Savings Account has been discontinued from 13- Dec2023. Additionally, Infinity Savings Account is now renamed as AMAZE Savings Account. However, users onboarded before 13- Dec- 2023 will continue to enjoy the product features & benefits as per previously communicated TnC

2. By choosing to opt for the Infinity Savings Account with Axis Bank, customer agrees to all the terms and conditions linked to Infinity Savings Account as covered below

3. Infinity Savings Account is a fixed fee-based account where customer is required to pay a fixed amount of fee at a pre-defined interval to the bank in exchange of the benefits linked to the usage of the account

- a. Customer will have following interval periods to choose from:

- In case of monthly plan selected, customer agrees to pay 6-month fees (180-day) upfront at the time on on-boarding as a one-time fee. Post 6 months, monthly fee cycle will continue.

*Please note in case of monthly plan selected, first payment of INR 900 to be made which will allow customer to avail benefits for 6 months (180-days)

4. Bank will auto-debit the fee as specified above on due date post completion of ongoing cycle (monthly or annually) directly from customers account balance. Renewal fee charges shall remain same as shown at the time of account opening unless specified or intimated to customer

5. Customer agrees to ensure that there is sufficient balance in the account on the day of fee deduction as per Monthly or Annual Plan

- a. Customer agrees that if there is no balance in account on the day of charge deduction, lien would be marked for the renewal amount and any due charges would be collected as and when the customer funds the account next

- b. If the customer does not keep sufficient balance in the account for 18 consecutive months because of which bank is unable to collect any fee from customer for this account, s/he agrees that his/her account would be automatically closed

6. Customer agrees to make an Initial Funding at the time of opening the account as applicable over and above the fee amount as applicable basis the selected plan

7. Customer agrees that there would be no refund of fees once collected in any case

8. Customer agrees that s/he can opt out of the plan anytime by migrating their account variant to any other type of account by visiting any of Axis Bank branches Alternatively, customer can opt for closure of the account by visiting their nearest branch

- a. Customer agrees that s/he can only migrate from Infinity Savings Account to ASAP Easy Savings Account variant

- b. Please note, in-case customer chooses to opt-out of the Infinity Savings account or close the account, customer will not be eligible for any refund for the fee paid already but benefit not availed

- c. Post customer opt-out date, fees & charges as per the new product variant shall be applicable

9. Customer agrees & is entitled to avail benefits of no charges for transactions as stated in the table 1.1 below would be incurred from the account activation date for the Infinity Savings Account till the account closure/opt-out date

- a. Bank reserves the right to withdraw the benefit for any of the transaction at any point of time in case of any misuse or unfair usage of the feature identified

- b. Bank reserves the right to charge customer over and above the fee collected in case of any misuse or unfair usage of the feature identified

- c. Customer agrees that the list of charges stated in the table 1.1 is exhaustive. Any other charges not falling under the table will not be waived off

10. Customer agrees that Forex related transactions and Add- On Service charges won’t be waived off under the current plan and charges for these transactions will be levied from their account directly basis usage and as specified in table 1.2 below

11. Product Migration or Discontinuation: The bank has the right to discontinue the Infinity Savings Account variant & migrate the account to ASAP Easy Savings Account variant at any point of time